Sales Tax Penalty Waiver Sample Letter | A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. Please note, you can also request . Mailing address (street, city, state . The sender was out of . We'll break down everything you need to know about paying taxe.

And the more we know about them as adults the easier our finances become. And if you're reading this article, you're probably curious to know what exactly you're paying for. Small business owners have a lot on their plates. Casualty, disaster) for not complying with the tax laws, you may request a . If you're a working american citizen, you most likely have to pay your taxes.

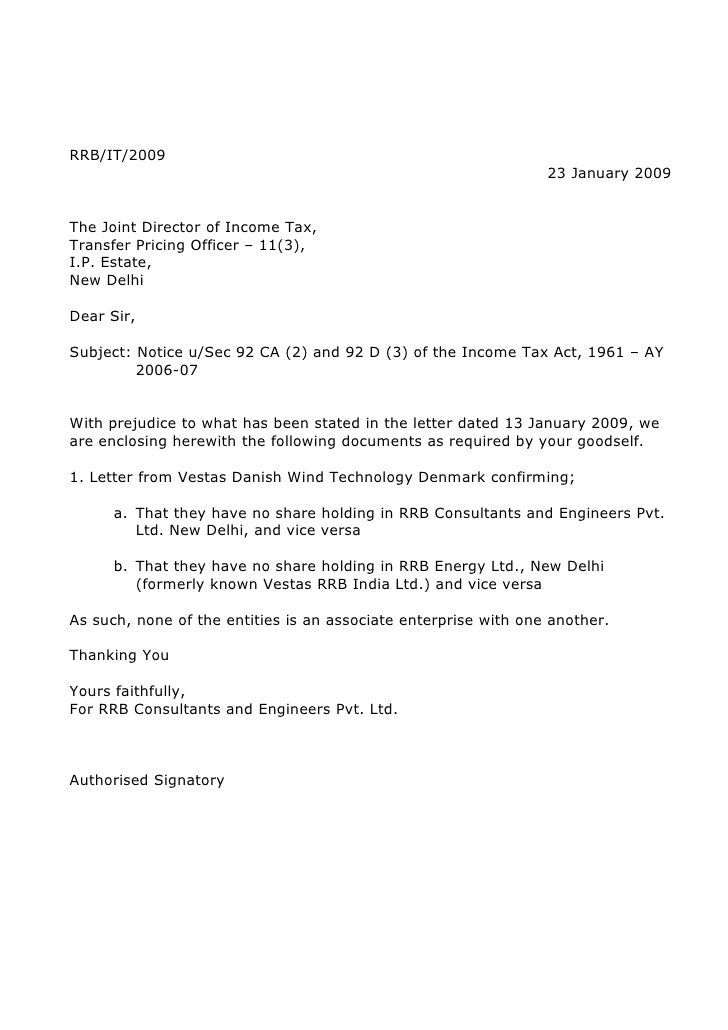

We'll break down everything you need to know about paying taxe. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. (1) i am writing to respectfully request an abatement/a waiver in the amount of $______, which i received for state the penalty you incurred . As the old adage goes, taxes are a fact of life. Mailing address (street, city, state . If you have been charged a penalty but believe you have reasonable cause (e.g. A template letter to kra to request for waiver on penalties and interest for late filing of kra tax returns , for business or indivindual. If you're a working american citizen, you most likely have to pay your taxes. The sender is writing to request waiving the penalty / interest regarding his / her late payment for various reasons. And the more we know about them as adults the easier our finances become. · the taxpayer should clearly state the tax penalty levied that they desire to be removed. Please note, you can also request . What is a penalty abatement request letter?

Amount due is made within 10 days. (1) i am writing to respectfully request an abatement/a waiver in the amount of $______, which i received for state the penalty you incurred . From juggling inventory to managing payroll and navigating tricky rules and regulations, the number of stressful tasks can seem overwhelming. One of the most crucial tasks for a business own. If you're a working american citizen, you most likely have to pay your taxes.

enter tax form and tax period. Small business owners have a lot on their plates. Please note, you can also request . From juggling inventory to managing payroll and navigating tricky rules and regulations, the number of stressful tasks can seem overwhelming. Amount due is made within 10 days. Casualty, disaster) for not complying with the tax laws, you may request a . After you have paid the tax and the interest, write a letter to the attorney general's office. The attorney general will forward the request to department of . If you have been charged a penalty but believe you have reasonable cause (e.g. If so, the tax practitioner should write a letter to the irs to . We'll break down everything you need to know about paying taxe. What is a penalty abatement request letter? · the taxpayer should clearly state the tax penalty levied that they desire to be removed.

We'll break down everything you need to know about paying taxe. One of the most crucial tasks for a business own. Amount due is made within 10 days. After you have paid the tax and the interest, write a letter to the attorney general's office. What is a penalty abatement request letter?

· the taxpayer should clearly state the tax penalty levied that they desire to be removed. Casualty, disaster) for not complying with the tax laws, you may request a . If you have been charged a penalty but believe you have reasonable cause (e.g. Please note, you can also request . (1) i am writing to respectfully request an abatement/a waiver in the amount of $______, which i received for state the penalty you incurred . enter tax form and tax period. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. What is a penalty abatement request letter? A template letter to kra to request for waiver on penalties and interest for late filing of kra tax returns , for business or indivindual. One of the most crucial tasks for a business own. As the old adage goes, taxes are a fact of life. And if you're reading this article, you're probably curious to know what exactly you're paying for. If so, the tax practitioner should write a letter to the irs to .

Sales Tax Penalty Waiver Sample Letter: What is a penalty abatement request letter?